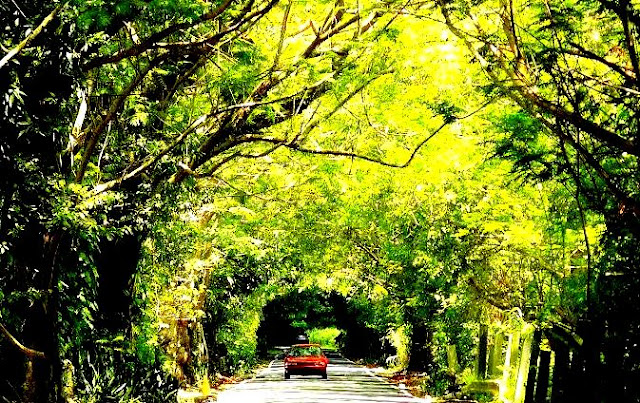

Get Started, One Step At A Time

When we finally decide to manage our financial situation and get out of debt we often feel lost, or how to get started. There are so many things to consider. Most of us cannot tackle them all simultaneously. Many end up putting it off and never actually get started. Just like walking, one foot in front of the other.

You can accomplish your goals by attacking one task at a time.

Erasing credit card debt, paying off your car early, taking on a 15 year mortgage instead of paying it off in 30 are not easy tasks and may even seem unachievable, but paying off one credit card or adding an extra $50 into your savings account this month are achievable goals.

Create a budget. This is your starting point whether your goal is to achieve financial freedom, saving for the down-payment on a house, funding your retirement or simply becoming debt free.

This is accomplished by listing all your income. Take into account every dollar that comes in. Then list all your expenses. Do not forget to include the variable expenses like entertainment and hobbies; we all need some. At times the expenses are higher than the income. Living on credit and the expenses need to be reduced.

First focus on eliminating debt. There are several ways to approach the situation. Two of the more common methods utilized are the “snowball” and “avalanche” methods. Make a list of all your debt and then utilize the method that best works for you.

Snowball-This list is prioritized from smallest to largest amount regardless of interest rate. You make the minimum payments on all and direct the remaining available funds towards the smallest debt. Therefore eliminating that small debt rather quickly. Once the first item is eliminated, you move to the second item and so on.

Avalanche-This list is prioritized by interest rate. Here the minimum payment on each debt is made, and all remaining funds go towards repaying the debt with the highest interest rate. Like with the snowball method, once the first item is completely paid off, you tackle the next one. This process continues until all debt is eliminated.

The benefits of the snowball method are primarily psychological; when you eliminate that first debt, you see progress and stay motivated because there is a sense of accomplishment. This approach works for those that need a quick win.

I am a proponent of the avalanche method because it usually saves both time and money, making it the more logical way to pay off your debts.

Whatever method you choose, stay the course. Eliminating debt is one of the pillars of personal finance.

Your next step is to start saving for retirement. Utilize an employee sponsored 401K if available and contribute at minimum enough to get the company match. I try and contribute the maximum the IRS allows.

I contribute into the company sponsored 401K. Three pluses; I get to take advantage of the company match, the compounding interest and the tax relief provided. The company match alone should easily beat the interest accrued by keeping a savings account.

Another option is to contribute to an IRA. Pick one from a discount broker. For many an HSA is also available. Mutual funds offer another option. Due diligence is required. Seek out an advisor and most importantly use common sense.

Many advocate creating an emergency fund that holds between three and six months of expenses. They say that along with providing for unforeseen expenses, an emergency fund provides peace of mind. I am not a fan of the EF and think there are better options instead. A savings account does not even keep up with inflation!

I am not fond of the emergency fund and as such do not have one, but would never discourage anyone from having one.

For short-term savings, say three to six months worth of expenses you may want to look into purchasing a certificate of deposit, treasury notes or a Christmas/vacation club.

Look to reduce expenses. Your cell plan, cable and internet contracts can all be renegotiated in your favor. Give them a call, if you are unsure of what to say run an internet search, there are step by step guides available. Used them. With one call you can potentially save $120 a year. That is on each bill! How about that ROI on your time?

The larger payments, the mortgage, the car, the student loans can also be renegotiated. I cut about eight years and saved approximately $45,000 from my original mortgage by going from a 30 year mortgage to a 15 year mortgage. The cost was negligible. Your student loans can be consolidated for the purpose of lowering payments. Federal loans must be consolidated as one loan separate from any private debt. A little research can save you thousands.

While frugality and minimalism may not be your cup of tea, the concepts should be visited.

Most of us cannot go about our daily lives with just two pairs of shoes and a wardrobe that fits in a backpack, but we don't need a walk-in closet full of power suits and the footwear that goes along with them either. Meet somewhere in the middle.

Break it down into tasks, complete one before you move on to the next. Things are much simpler this way. Get started today, your future self will thank you.

What was your first step?

I am a proponent of the avalanche method because it usually saves both time and money, making it the more logical way to pay off your debts.

Whatever method you choose, stay the course. Eliminating debt is one of the pillars of personal finance.

Your next step is to start saving for retirement. Utilize an employee sponsored 401K if available and contribute at minimum enough to get the company match. I try and contribute the maximum the IRS allows.

I contribute into the company sponsored 401K. Three pluses; I get to take advantage of the company match, the compounding interest and the tax relief provided. The company match alone should easily beat the interest accrued by keeping a savings account.

Another option is to contribute to an IRA. Pick one from a discount broker. For many an HSA is also available. Mutual funds offer another option. Due diligence is required. Seek out an advisor and most importantly use common sense.

Many advocate creating an emergency fund that holds between three and six months of expenses. They say that along with providing for unforeseen expenses, an emergency fund provides peace of mind. I am not a fan of the EF and think there are better options instead. A savings account does not even keep up with inflation!

I am not fond of the emergency fund and as such do not have one, but would never discourage anyone from having one.

For short-term savings, say three to six months worth of expenses you may want to look into purchasing a certificate of deposit, treasury notes or a Christmas/vacation club.

Look to reduce expenses. Your cell plan, cable and internet contracts can all be renegotiated in your favor. Give them a call, if you are unsure of what to say run an internet search, there are step by step guides available. Used them. With one call you can potentially save $120 a year. That is on each bill! How about that ROI on your time?

The larger payments, the mortgage, the car, the student loans can also be renegotiated. I cut about eight years and saved approximately $45,000 from my original mortgage by going from a 30 year mortgage to a 15 year mortgage. The cost was negligible. Your student loans can be consolidated for the purpose of lowering payments. Federal loans must be consolidated as one loan separate from any private debt. A little research can save you thousands.

While frugality and minimalism may not be your cup of tea, the concepts should be visited.

Most of us cannot go about our daily lives with just two pairs of shoes and a wardrobe that fits in a backpack, but we don't need a walk-in closet full of power suits and the footwear that goes along with them either. Meet somewhere in the middle.

Break it down into tasks, complete one before you move on to the next. Things are much simpler this way. Get started today, your future self will thank you.

What was your first step?

The views here expressed are all my own and are not legal, professional or financial advice. You should consult a professional before investing. Referral links may be found throughout, I only recommend products I believe in. This site also presents links to other sites but is not responsible for their content or privacy practices.

Comments

Post a Comment